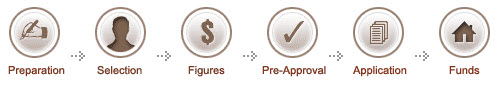

The Loan Process – Preparation

Where do you begin to secure finances for purchasing a new home, refinancing an existing home, or obtaining a real estate equity line of credit? Loan acquisition can get confusing, but you can simplify the process and avoid a lot of potential headaches by getting off to a good start. Here are a couple of ways to do so:

Build your green file.

Organizing and compiling all pertinent financial documents into a green file is an absolute must for any potential borrower. Think of the green file as a resume or profile that will give lenders an idea of what kind of debtor you might be. The typical green file should contain:

• Financial statements

• Bank accounts

• Investments

• Credit card

• Auto loans

• Recent pay stubs

• Tax returns for two years

Consider your credit rating.

Another means by which lenders gauge your trustworthiness as a borrower is through your credit rating. These indicate your credit history, which includes such crucial information as the number of your open loans and the punctuality of your past payments.

• Treat your credit like gold.

Credit ratings are important because they often determine whether or not you will be approved for a loan and what your interest rate will be. Thus, you cannot take your credit seriously enough! We suggest checking your credit reports at least once a year or before making any major purchase to ensure the accuracy of the information contained there.

• What the scores mean.

Ratings usually vary between 400 and 800. Anything above 620 is good. If you exceed 680, you are considered premium and may even get a lower interest rate.

• Determine your credit rating.

You can do this by contacting a credit reporting agency such as Equifax, Experian or Trans Union. Above all, don’t hesitate to consult with your lender if you need to improve your rating.

Prioritize your costs and savings.

Buying real estate wisely is all about choosing what to spend for first.

• Prioritize your costs.

Down payments, closing costs and additional expenses (such as inspections) should be at the top of your list. On the other hand, be sure to pay down on your current revolving and high-interest rate debts, such as credit cards.

• Remember: lenders like stability.

Instill confidence in your potential lender by avoiding any big, sudden moves both in your career and your finances. If that job change or big budget purchase absolutely cannot be postponed, check with your lender first and consider the consequences.