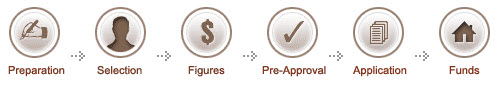

The Loan Process – Selection

Choose a Lender

Securing finances requires a decision that you may have to live with for thirty years—so spend time comparing different lenders before making your choice. There are a number of ways to find one, whether through traditional print ads, Realtor referrals or Internet sources. There are also several considerations to keep in mind when shopping for the right lender and program:

• Price.

Consider the competitiveness of a lender’s prices with that of others, especially for mortgage rates, interest rates, and additional costs.

• Diversity of products.

Price is important but by no means should it be your only determining factor. How extensive is the lender’s range of offered loan programs? Check the availability of the program most appropriate to your credit profile and property.

• Rapport.

Do your lenders and brokers communicate effectively and thoroughly? Are they attentive and prompt? You aren’t looking for just a guide but a partner—someone you can work with and trust every step of the way.

• Connections.

Check whether the lender has access to local loan approval committees that understand your goals as a borrower.

Choose a Loan

Though there are many different kinds of loans available today, these three are the most commonly used:

• Fixed loan.

This long-term option requires monthly payments that will remain the same throughout the duration of the loan, which may vary from fifteen to thirty years. Though it’s the most affordable short-term solution, it may cost more than shorter term mortgages over the life of the loan.

• Adjustable rate mortgage (ARM).

The loan rate here will be determined by factors such as index, readjustment intervals, and capitalization rate. The initial interest rate can be as much as 2 to 3 percent lower than a comparable fixed rate mortgage, which can make homeownership more affordable. However you should first examine variant factors and downside risks before seriously considering this option.

• Hybrid loan.

Also known as an intermediate or convertable ARM, it offers a fixed interest rate for a specified initial period before it ‘switches’ to an ARM and adjusts with the market every six months or every year.

Consult with your lender to assess which loan type and program would best correspond with your resources and needs.