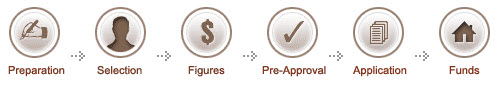

The Loan Process – Pre-Approval

How is pre-approval different from pre-qualification? What are the advantages of each and which option would be the best for you?

Pre-Qualification

This is an assessment by the lender, based on certain basic information given by the borrower (e.g. employment, income, asset information, current monthly debt, and credit worthiness). Based on this quick evaluation the lender makes a tentative decision to pre-qualify the borrower for a certain loan amount. This does not commit the lender at all to the applicant, being only an opinion of the lender.

Pre-Approval

Like a pre-qualification, a pre-approval involves a lender making an assessment of a borrower’s buying capacity based on her or his income. But unlike a pre-qualification, a pre-approval letter also checks the applicant’s credit and is a surer verification of a borrower’s income. It takes longer to process and will require more comprehensive documentation, but gives a clearer and more definitive guarantee of the loan amount a borrower is entitled to.

Why Choose Pre-Approval?

It’s advisable to go straight to a pre-approval for several reasons. A pre-approval can strengthen your purchasing power: as a far more accurate evaluation of how much house or real estate you are capable of buying, it will be more appealing and thus perform better than a pre-qualification in a competitive sellers’ market. It’s also more time-effective since it reduces the time your lender will need to process and fund your loan.